Any figure you see reported on the financial results of replica Rolex SA — the global organisation owned by the private family trust Hans Wilsdorf Foundation — is an estimate.

Investment bank Morgan Stanley puts the 2019 turnover figure at CHF 5.2 billion (£4.4 billion) in 2019 from the sale of one million watches. It estimates an additional CHF 310 million for Tudor in 2019 from the sale of 210,000 units.

Thanks to accounting laws in the United Kingdom, Rolex Watch Company Ltd, the wholly-owned distributor for luxury replica Rolex watches for sale (and the founding company of Rolex when it emerged in London in 1915), has to publish its financial results.

Today is the day they report their 2019 results.

First, a little bit of context. The total value of all watches sold at all price points in 2019 — at retail prices — was £1.49 billion, down a whisker from £1.51 billion in 2018, according to analyst GfK.

Swiss watch export figures tell broadly the same story, with the UK rising from a market worth CHF 1.2 billion in 2018 to CHF 1.3 billion in 2019. These is a measure of wholesale value.

In short, the overall UK market was flat last year.

Not for Rolex.

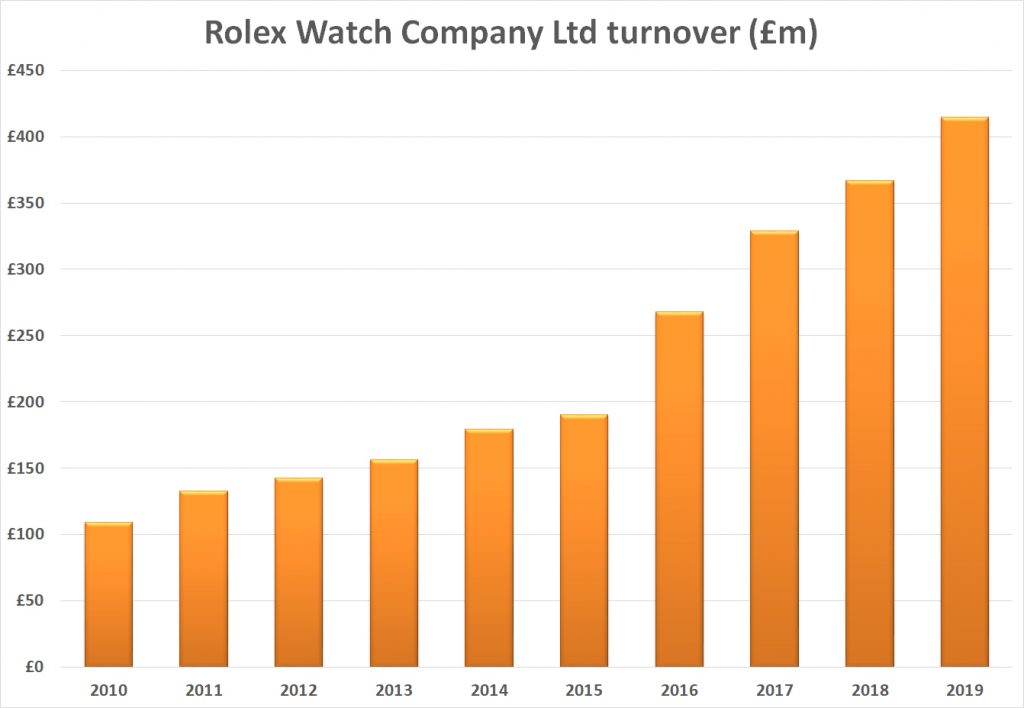

Accounts published today at the government-owned Companies House show revenue for Rolex, including Tudor, rising by 13%, from £367 million to £415 million.

Operating profit shot up by 27% to £70.2 million.

If Morgan Stanley’s estimate of Rolex global turnover estimate of CHF 5.2 billion (£4.4bn) is correct, that would mean just shy of 10% of Rolex global sales came from the UK.

This compares to the UK amounting to 6.3% of the global watch market for Swiss watches, based on export figures.

ANALYSIS

In an era where allocations for Swiss automatic movement fake Rolex watches to their authorised dealers is arguably the most important issue facing every one if its retail partners, the UK is punching well above its weight.

This appears to be a reflection of the huge investment retailers such as Bucherer and The Watches of Switzerland Group have been prepared to make in upgrading their Rolex presentation from small shop in shops to full blown monobrand boutiques.

WOSG CEO Brian Duffy has said as much. The only way to influence allocation is to invest more, he has told investors and the media on many occasions.

Rolex Watch Company Ltd made no mention of the impact of Covid-19 in its financial statement, despite the report being filed at Companies House over the summer of this year.

As always, aaa quality copy Rolex watches played its cards very close to its chest and the only guidance it gave in its 2019 accounts about the situation in 2020 is that it faces competitive threats from other watch brands and could see results affected by currency fluctuations with the Swiss franc.

It is ridiculous to believe these are the only headwinds facing the business.

There was no mention about production capacity being lost because its factories had to shut down during the covid quarter, which retailers have told us would have robbed the world of 25-30% of this year’s output.

We will only get answers to these questions when next year’s accounts are published, so tune in next October to see how the pandemic has impacted Rolex in the UK.